Executive Summary

Mid-sized companies in Southeast Asia are currently operating within a highly volatile business environment characterized by economic uncertainty, persistent supply chain disruptions, evolving regulatory landscapes, and rapid technological evolution. In 2025, the ability to demonstrate resilience is no longer merely advantageous; it has become a fundamental strategic imperative for sustained growth and survival, particularly for mid-market enterprises. This white paper explores how leading mid-market firms in the region are strategically adapting to these multifaceted challenges. Key strategies include embracing cloud ERP solutions, diversifying operational footprints, and embedding agility directly into their core business models to future-proof their operations against unforeseen market dynamics, ensuring the strength of the mid-market sector.

1. The Volatility Challenge for Mid-Market Firms in Southeast Asia

Southeast Asian businesses are facing a complex interplay of forces that are fundamentally reshaping the operational landscape. Mid-sized companies, while often possessing inherent agility, are particularly vulnerable due to their typically more limited buffers compared to larger enterprises. Understanding these forces is crucial for developing effective resilience strategies for the mid-market segment.

1.1. Economic Uncertainty Impacting the Mid-Market

The region is experiencing a period of significant economic uncertainty, marked by:

- Slower Global Demand: A general deceleration in global economic activity is impacting export-oriented businesses across the mid-market.

- Tariff Changes and Trade Volatility: Shifts in global trade policies, particularly those originating from major economies like the US, create unpredictability in market access and cost structures for businesses.

- Inflationary Pressure: Rising costs across various sectors continue to erode profit margins for these growth-oriented companies.

- High Interest Rates and Dampened Investment: Sustained high interest rates in Southeast Asia limit access to affordable capital, consequently dampening investment appetite for expansion and modernization among mid-sized enterprises.

- Foreign Exchange Volatility and Capital Outflows: Fluctuating currency rates and the movement of capital out of the region increase financial risks for mid-market leaders engaged in international trade or with foreign investors.

These factors necessitate rapid responses to margin pressures and shifting cost structures, requiring mid-market businesses to adapt swiftly to dynamic economic conditions.

1.2. Supply Chain Fragility Affecting Mid-Market Enterprises

Global supply chains remain susceptible to disruption, with particular challenges in Southeast Asia stemming from:

- “China+1” Strategy Disruptions: The ongoing trend of companies diversifying their manufacturing and sourcing bases beyond China, while a long-term resilience strategy, introduces short-term complexities and necessitates the establishment of new, robust supply networks across countries such as Malaysia, India, Vietnam, and Indonesia for mid-market players.

- Geopolitical Tensions: Geopolitical dynamics, notably US-China relations, can accelerate shifts in supply chain dependencies, making traditional supplier agreements less viable or more costly. This mandates urgent re-evaluation and pivoting of sourcing strategies for operations.

- Unpredictable Shipping Costs and Delays: Volatility in global logistics, including fluctuating shipping costs and recurrent delays, continues to add layers of uncertainty to supply chain planning and execution for the companies.

These factors demand a fundamental rethinking of supply chain architecture to build in redundancy and flexibility for the mid-market.

1.3. Increasing Regulatory Demands for Mid-Market Businesses

Mid-market businesses are navigating an increasingly complex and dynamic regulatory environment, including:

- ESG Reporting Frameworks: Mandatory ESG reporting is becoming standard across the region, with specific emphasis on carbon footprint reporting, particularly for companies engaged with European markets.

- Tightening Digital Tax Regulations: The proliferation of digital services and cross-border e-commerce is leading to more stringent digital tax regulations, impacting finance teams.

- E-Invoicing Mandates: Countries like Malaysia have already begun enforcing e-invoicing, with Singapore and others poised to follow, requiring significant adjustments to financial transaction processing.

- Evolving Data Privacy Laws: Data privacy regulations are continually being updated and expanded, impacting how mid-market firms collect, store, and utilize customer and operational data.

- AI Governance in the Spotlight: As AI adoption accelerates, regulatory frameworks around its ethical use, data handling, and accountability are beginning to emerge, posing new compliance challenges.

Compliance across multiple jurisdictions requires robust, built-in controls rather than reliance on manual processes or ad-hoc workarounds for mid-market organizations.

1.4. Accelerated Customer Expectations and Digital Disruption for the Mid-Market

The pace of technological change continues to accelerate, driven by:

- AI Reshaping Workflows: Artificial intelligence is fundamentally altering how work is performed, from advanced predictive analytics to automated financial processes, presenting both opportunities and challenges for mid-market growth.

- Digital-First, Real-Time Experiences: Customers now expect seamless, digital-first interactions and immediate access to information, minimizing the need for lengthy manual engagements with mid-market providers.

- Pressure to Modernize: Companies that fail to modernize their digital infrastructure risk falling behind competitors who leverage technology for efficiency and enhanced customer experience.

While challenging, technological acceleration also presents opportunities for mid-market firms to leverage advanced tools without needing to be large technology giants.

2. Characteristics of a Resilient Mid-Market Business in 2025

Resilient mid-market companies in Southeast Asia share a common set of characteristics that enable them to not just survive, but thrive amidst volatility. These traits represent a set of capabilities that can be strategically developed and integrated into the mid-market business model:

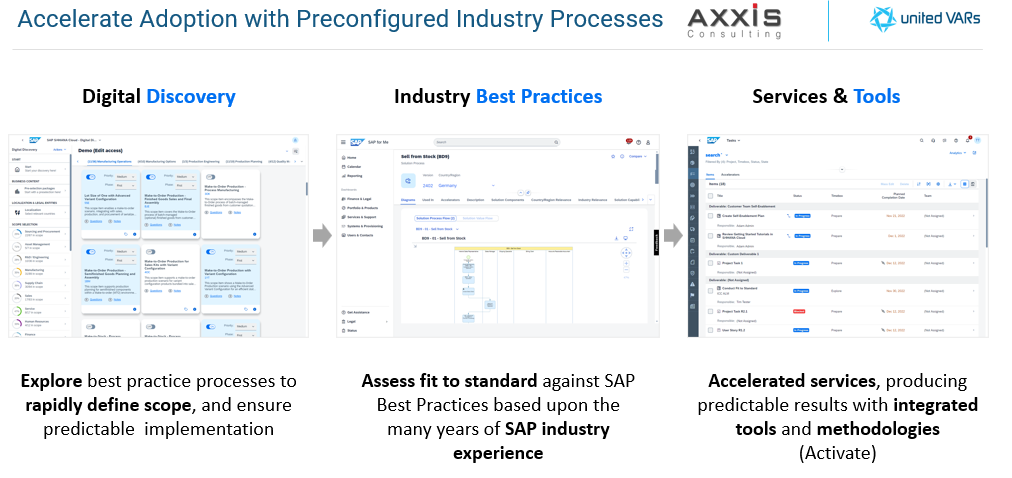

- Real-Time Decision-Making: The ability to leverage live, granular data to guide operational and strategic decisions, enabling immediate course corrections. This contrasts sharply with reliance on outdated reports for the leaders.

- Operational Agility: The capacity for mid-market enterprises to rapidly adjust to unforeseen market shifts, supply chain disruptions, or sudden changes in demand. This means having flexible processes and systems that support quick pivots.

- Regulatory Readiness: Proactive measures and systemic controls to maintain continuous compliance across diverse and evolving regulatory frameworks (e.g., ESG, digital tax, data privacy) in multiple jurisdictions for operations.

- Tech-Driven Scalability: The capability for the businesses to grow operations without proportional increases in complexity or resource allocation, achieved through modern, scalable technology infrastructure.

3. Strategic Actions Taken by Leading Mid-Sized Firms

![]()

Forward-looking mid-sized companies are actively implementing strategic initiatives to build resilience. These are not passive reactions but deliberate transformations of their operational models:

- Diversifying Supply Chains: Implementing “China+1” strategies, regional sourcing, and establishing supplier redundancy to mitigate geopolitical and logistical risks. This includes setting up operations in countries like Vietnam, Indonesia, or Malaysia to reduce over-dependence on a single region or supplier, a common strategy for mid-market expansion.

- Driving Digital Transformation: Modernizing enterprise resource planning (ERP) systems to cloud-based platforms and integrating advanced technologies like AI and analytics. This automates core business processes (e.g., procurement, finance, sales), reduces manual workload, eliminates inefficiencies, and provides enhanced control across operations, thereby laying the groundwork for scalable, data-driven growth for mid-market players.

- Adopting Agile Operations: Transitioning to modular, cloud-first platforms that can scale and evolve with business needs. This flexibility is crucial for launching new products, entering new markets, or restructuring supply chains with minimal disruption, ensuring the ERP system supports, rather than hinders, strategic pivots for the businesses.

- Focusing on Risk Management: Embedding business continuity and scenario planning into core strategic processes. This involves formalizing plans, investing in backup suppliers, building flexible workforce models, and using scenario analysis to prepare for various disruption scenarios, transforming risk management from a compliance checkbox into an operational advantage for mid-market entities.

- Becoming Data-Driven: Leveraging embedded analytics and centralized data models to enable predictive decision-making. This allows for real-time monitoring of performance, accurate demand forecasting, and immediate course correction, shifting from reactive to proactive operations for smarter, faster strategic alignment with real-world dynamics, vital for mid-market competitiveness.

4. Why Cloud ERP is Foundational to Mid-Market Resilience

Legacy ERP systems, often characterized by fragmented data, manual processes, and rigid architectures, simply cannot support the pace of change required in today’s volatile environment. Cloud ERP solutions, conversely, are inherently designed for agility, scalability, and modern business demands, making them ideal for the mid-market. It is akin to upgrading from a basic flip phone to a sophisticated smartphone: while the flip phone may still technically function, it fundamentally lacks the capabilities required for contemporary living and working.

The foundational advantages of Cloud ERP for mid-market resilience include:

- Real-Time Visibility: Cloud ERP systems provide instant, unified views of operations, eliminating data silos and enabling immediate insights into profitability, stock levels, receivables, and more, all based on live transactional data, which is crucial for mid-market agility.

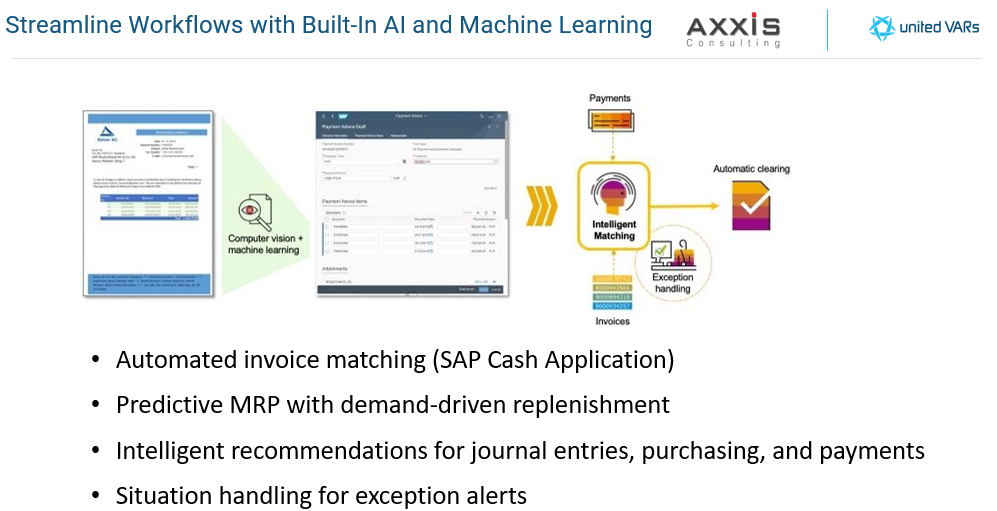

- Built-in Automation and AI: These systems come with native automation tools and AI capabilities, such as intelligent cash application for payment matching or AI-powered MRP for replenishment suggestions, significantly reducing manual effort and improving decision accuracy for finance and operations.

- Scalability with Business Growth: Unlike on-premise systems with fixed hardware capacities, cloud ERP offers elasticity, allowing businesses to scale resources up or down as needed, with predictable, subscription-based costs.

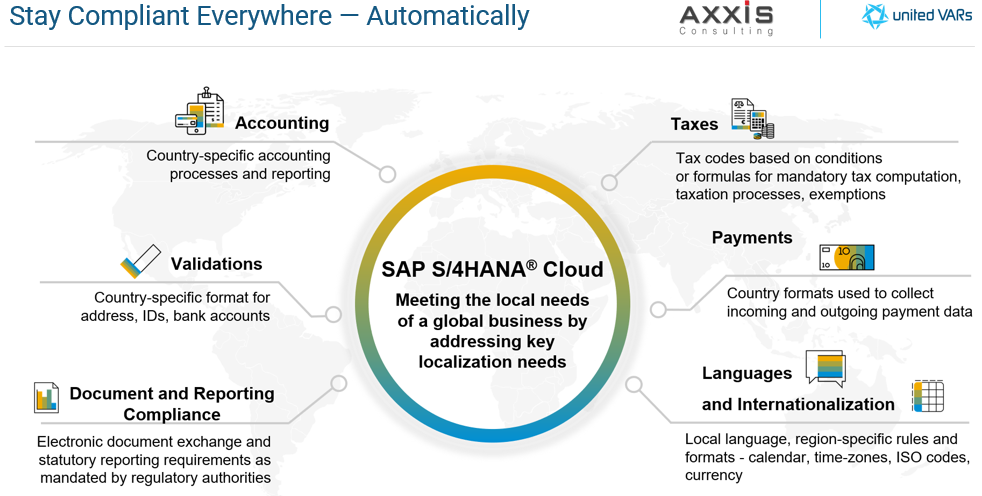

- Global Compliance: Cloud ERP systems inherently support multi-jurisdictional compliance for various regulations (e.g., tax, ESG) with automated updates, ensuring businesses remain compliant without constant manual intervention.

- Lower Total Cost of Ownership (TCO): Cloud ERP shifts costs from high upfront capital expenditure and ongoing, unpredictable maintenance to a predictable subscription model, simplifying financial planning and reducing the burden on internal IT teams for mid-market companies.

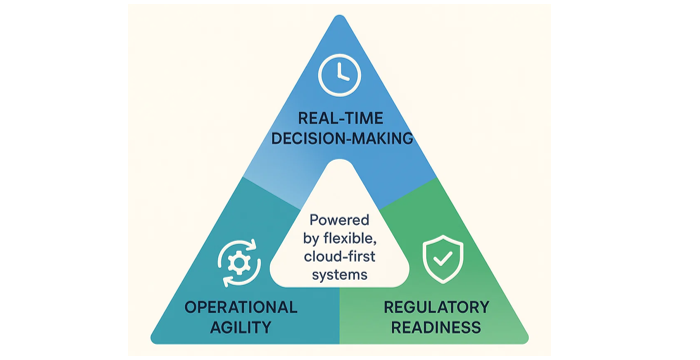

SAP S/4HANA Cloud Public Edition exemplifies these benefits, providing real-time analytics, AI-powered automation, preconfigured best practices based on decades of industry experience, and robust global compliance features, all within a scalable, cloud-native architecture.

4.1. More about SAP S/4HANA Cloud Public Edition

SAP S/4HANA Cloud is a complete end-to-end solution to manage all aspects of the entire business, from Finance to Procurement, Sales to Service, from R&D to Manufacturing and all the other supporting functions. It includes group reporting, in-built analytics, and covers compliance requirements for tax and ESG reporting.

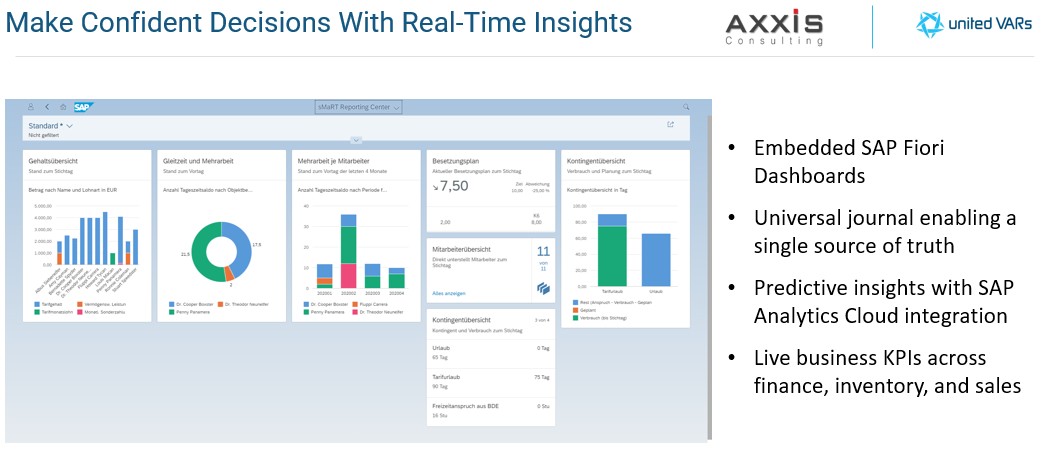

SAP S/4HANA Cloud includes embedded analytics in the same system — you don’t need to export to Excel or wait for BI reports. Using SAP Fiori apps and real-time dashboards, you can monitor profitability, stock levels, receivables, and more — all based on live transactional data. The universal journal architecture means all your financial and managerial reporting comes from one source, reducing reconciliation efforts and reporting delays.

Procurement Overview Dashboard Fiori App allows Procurement Manager & Internal Procurement team to proactively

- Monitor key KPIs & gain full visibility of the entire on-going procurement processes

- View reports in various visualizations in real time

- Access other applications/ functions within the system

The Procurement Overview shows, at a glance, the most important information and tasks relevant for you right now. The information is displayed on set of actionable cards. You can therefore focus on the most important tasks, enabling faster decisions and immediate action. The cards show you the most important information ranked according to relevance. For example, on the Monitor Purchase Contracts card, you can see the consumption and expiry date per contract. You can then decide to change a contract by selecting it.

You can use the global filter to filter the entire Procurement Overview by supplier or material group, for example. You then see all urgent contracts, purchase requisitions, or spend information according to the specified filter criteria. For list cards, selecting the header of a card brings you to the app itself, while selecting an item brings you to more detailed item information. For graphical or analytical cards, selecting the card brings you to more detailed analytical information.

SAP S/4HANA Cloud includes intelligent technologies that automate routine work. For example, the SAP Cash Application uses machine learning to match incoming payments to invoices, reducing manual effort in finance. Predictive MRP suggests replenishment based on historical and forecasted data. And AI-powered situation handling brings up exceptions to users proactively — like late deliveries or blocked invoices — before they become bottlenecks.

Material Requirements Planning

Manage Material Coverage Fiori App allows the Inventory Team to

- Simulate material requirements based on incoming demands

- Gain visibility into demand requirements, which in turn, result in a better material planning process

- Apply suggested changes based off of the calculations done by the system

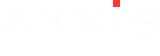

S/4HANA Cloud Public Edition comes with SAP Best Practices — these are fully documented, preconfigured business processes that reflect how leading companies operate. Whether you’re in manufacturing, distribution, or services, these templates help you go live faster and reduce risk. With SAP Activate, implementation is structured and efficient — you don’t start from a blank sheet.

Compliance is no longer optional — and S/4HANA Cloud helps you stay ahead. It includes built-in legal and regulatory content for over 40 countries, including GST in Singapore, VAT in Malaysia, and e-invoicing mandates in the region. ESG readiness with sustainability and audit trail capabilities. With continuous delivery updates, the system adjusts to changing tax laws and ESG frameworks — without requiring custom code or manual patching.

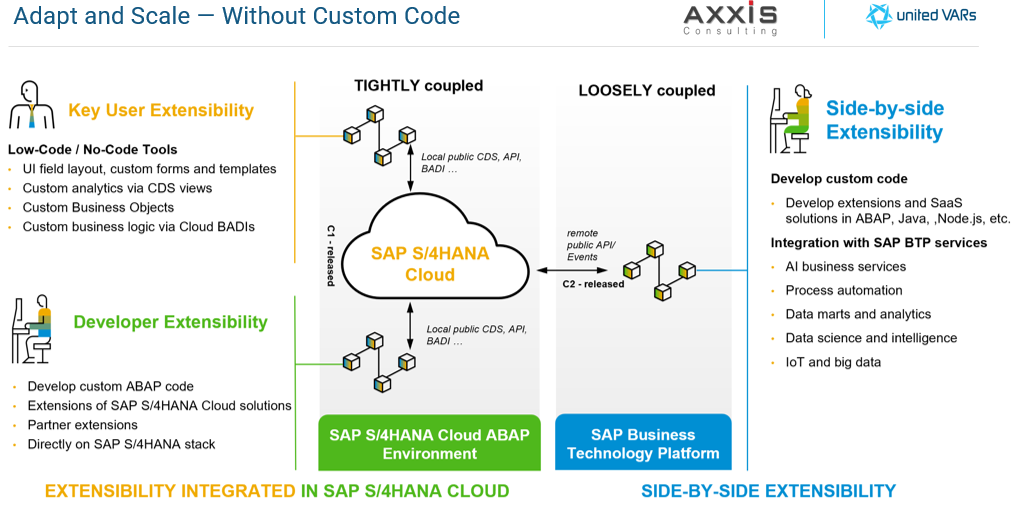

One of the big advantages of S/4HANA Cloud is that it’s both flexible and upgrade-safe. You can personalize apps, add new fields, create workflows — all without needing developers. If you need more advanced custom logic or integrations, SAP Business Technology Platform (BTP) allows secure side-by-side extensions — so your ERP core stays clean and always up to date.

5. Case Snapshot: Regional Distributor in Malaysia – A Mid-Market Success Story

A mid-sized distributor in Malaysia serves as a compelling example of successful digital transformation driving resilience. By transitioning from an on-premise ERP system to SAP S/4HANA Cloud Public Edition, the company, a typical mid-market enterprise, achieved notable improvements:

- 60% Faster Month-End Closing: Streamlined financial processes significantly reduced the time required for period-end activities, enhancing financial agility for this mid-market player.

- Real-Time Stock Visibility: Gained immediate, unified visibility into inventory levels across its operations in three different countries, optimizing supply chain management for the distributor.

- Automated Tax and ESG Reporting: Enhanced compliance through automated generation of critical regulatory reports, reducing manual effort and risk for the business.

- Over 40% Reduction in IT Maintenance: Shifting to the cloud significantly lowered ongoing IT infrastructure and maintenance costs, allowing for reallocation of resources for this company.

This case demonstrates the tangible benefits of adopting modern cloud ERP for operational efficiency and resilience within the mid-market segment.

6. Your Next Step: Start with Assessment for Your Mid-Market Business

Building organizational resilience in the current environment is a continuous journey that begins with a clear understanding of current capabilities and vulnerabilities. Mid-market leaders in Southeast Asia should take the following initial steps:

- Assess Current Operational Bottlenecks: Conduct a thorough review of existing processes and systems to identify areas that hinder efficiency, agility, and data-driven decision-making within your operation.

- Prioritize Impact Areas: Determine which identified bottlenecks or deficiencies have the most significant impact on the company’s agility, real-time insight capabilities, and overall resilience for your firm.

- Engage a Trusted SAP Partner: Collaborate with an experienced SAP partner for a comprehensive assessment and roadmap planning. Such a partner can provide expertise in aligning technological solutions with strategic business objectives.

Conclusion

The current business climate in Southeast Asia demands a proactive approach to resilience. Mid-sized companies that act decisively now, particularly by embracing modern digital transformation powered by cloud ERP, are not merely preparing to withstand future volatility; they are strategically positioning themselves to lead and define the next wave of growth. Resilience, underpinned by robust technological capabilities, will be the hallmark of successful mid-market enterprises in the coming years.

About Axxis Consulting

Axxis Consulting is a leading SAP solutions provider, built on decades of deep expertise in enterprise software. While the company was officially founded over 12 years ago, our team’s journey in the SAP ecosystem began much earlier—dating back to the previous millennium. Today, Axxis Consulting stands as an SAP Platinum Partner, an SAP-certified Partner Center of Expertise, and a proud member of United VARs, the world’s largest alliance of SAP solution providers. This deep experience makes us an ideal partner for digital transformation.

Headquartered in Singapore, with offices in Kuala Lumpur and a regional support team based in the Philippines, Axxis delivers SAP implementation and support services across 24 countries. We serve clients of all sizes and industries, from local SMEs to large enterprises and global corporations.

Our solution portfolio covers the full range of SAP products, including SAP S/4HANA (Public and Private Cloud), SAP Business One, and SAP Customer Experience (CX). These solutions enable our customers to build scalable, integrated, and future-ready digital environments—tailored to meet the demands of today’s fast-paced business landscape for mid-market companies.

Our affiliation with United VARs, an elite network of over 70 SAP partners operating in 100+ countries, allows us to deliver local expertise with global reach. This enables us to support multinational clients with on-the-ground service, language localization, and industry-specific knowledge, wherever they operate, proving invaluable for businesses with regional aspirations.

Most recently, we were honored as the Best SAP Growth Partner in Malaysia at the SAP Asia Pacific regional event—recognition for our success in helping clients like Resorts World Cruises adopt SAP S/4HANA Public Cloud. This award reflects our dedication to supporting mid-sized regional companies with scalable, cloud-based ERP solutions that drive growth and operational excellence.