In today’s fast-moving business environment in Southeast Asia — especially Malaysia and Singapore — selecting the right business software is critical. Many SMEs start with basic accounting tools like UBS (Access UBS, formerly Sage UBS), but then find themselves constrained as operations grow. SAP Business One offers a more integrated, scalable, and feature-rich path forward. Below is a deep dive: comparing what UBS offers, where it falls short for growing businesses, and how SAP Business One bridges those gaps with real added value.

Overview: What is UBS, and What is SAP Business One

Access UBS (Sage UBS)

- UBS is a well-established accounting & billing / inventory / payroll suite used widely by Malaysian SMEs.

- Major features include GL, AR, AP, fixed assets, inventory & billing, payroll, POS, building service maintenance, etc.

- Trusted by ~500,000 SME installations; many businesses use it because it is familiar, locally compliant, relatively affordable, and has features aligned with local regulatory requirements like SST, e-invoicing.

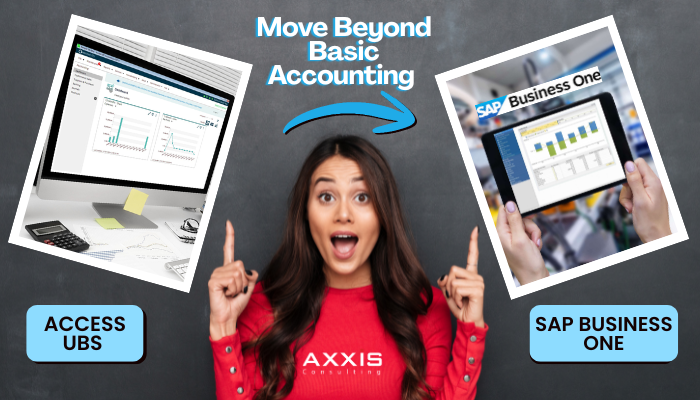

SAP Business One (SAP B1)

- An ERP (Enterprise Resource Planning) solution tailored for small-to-medium companies, with global presence but also localized capabilities.

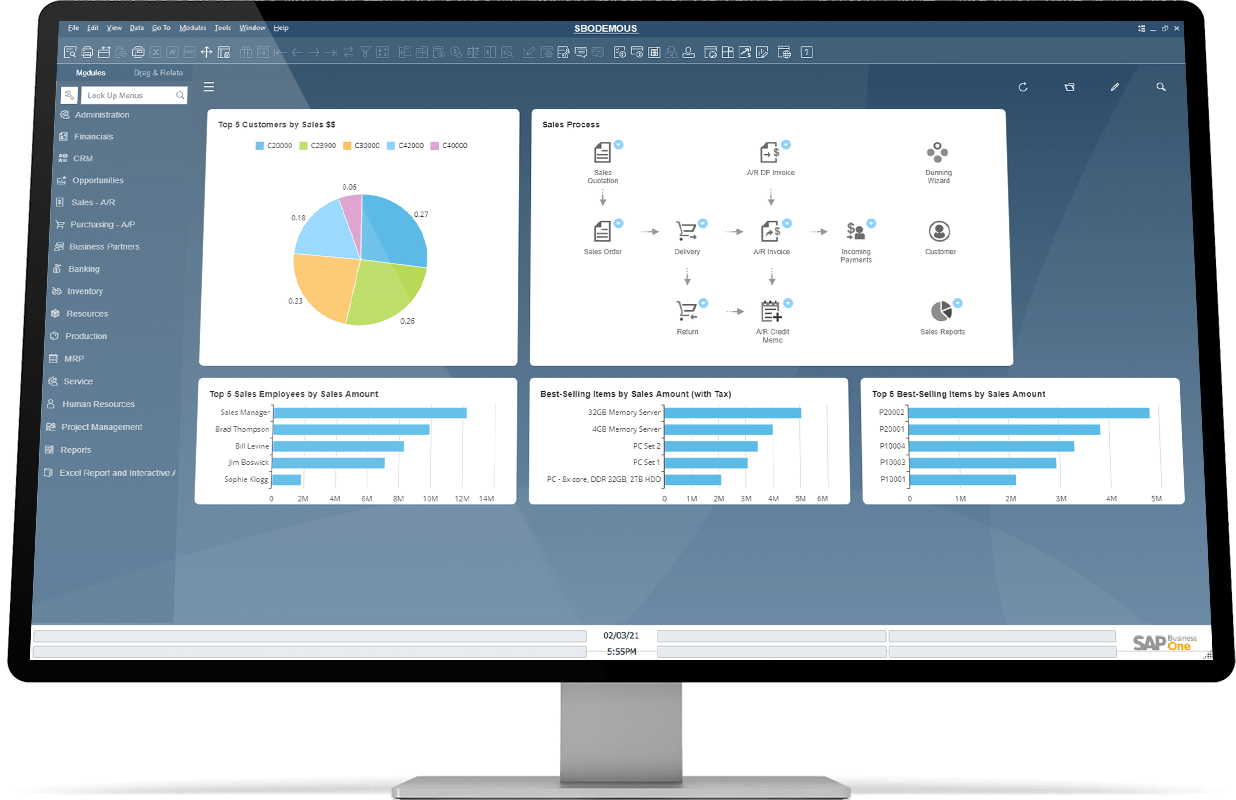

- Modules cover finance/accounts, sales & customer management, procurement, inventory, production/MRP, reporting & analytics, multi-currency and multi-company capabilities.

- Local partners in Malaysia and Singapore implement SAP B1 with enhancements and support to suit local laws, tax, inventory rules, multi-entity needs etc.

Key Dimensions of Comparison

The tables below compare UBS and SAP Business One across key dimensions that matter most to SMEs in Malaysia and Singapore — from compliance and usability to advanced functionality and total cost of ownership.

Core System Capabilities

| Dimension | What UBS Does Well | Where UBS Is Limited / How SAP Business One Adds Value |

|---|---|---|

| Local Compliance & Regulations | UBS is fully compliant with SST (Malaysia), supports LHDN e-invoicing, and aligns with local tax laws. |

|

| Scalability & Growth | UBS fits smaller firms — single company, limited users, basic inventory, billing, and payroll. |

|

| Integration & Unified Data | UBS links its accounting, inventory, and billing modules. |

|

Advanced Features, User Experience & Ecosystem

| Dimension | What UBS Does Well | Where UBS Is Limited / How SAP Business One Adds Value |

|---|---|---|

| Advanced Features & Tools | UBS Evo includes AI tools, e-invoicing, mobile access, and basic dashboards. |

|

| User Experience & Usability | UBS is simple, guided, and locally familiar for SMEs. |

|

| Cost & Total Cost of Ownership (TCO) | UBS has low upfront cost and simple setup. |

|

| Local Support & Ecosystem | UBS has strong local presence and support for SST/e-invoicing. |

|

Real Examples / Use Cases

Here are some glossed-examples to illustrate when UBS might suffice, and when SAP Business One becomes clearly better:

- Small local trading company with 1 or 2 companies, simple inventory, simple accounts, few users, predictable transactions → UBS is likely sufficient and economical.

- Business expanding into multiple branches (shops, warehouses) or multiple countries, needing multi-currency, intercompany consolidation → SAP Business One gives you tools built for that.

- Manufacturing shop with production planning, raw materials, batch scheduling, quality control → SAP Business One has better MRP / manufacturing features.

- Service business or field service company needing service contract management, follow-ups, service calls, customer history / CRM integrated with accounting → SAP Business One is stronger.

- Fast growth / high transaction volume businesses that need real-time visibility, dashboards, demand for analytics & forecasting → SAP Business One provides better tools to see into operations, not just financial bookkeeping.

Areas Where UBS Still Holds Strength

To be balanced, UBS is not without merits. In some scenarios, it remains a valid choice:

1. Lower upfront investment: For businesses just starting, tight on budget, UBS’ lower licensing + fewer complex modules means less initial spend.

2. Simplicity: Less overhead in training, fewer modules to manage; leaner setup.

3. Strong local compliance: Especially for Malaysian regulations, SST, LHDN, e-invoicing, etc. UBS tends to be very tuned to local needs and changes. This means less risk for regulatory non-compliance.

4. Established familiarity: Many accountants / bookkeepers in Malaysia/Singapore already know UBS. Less cultural / adoption friction.

Why SAP Business One Is the Better Long-Term Investment

Putting the pieces together, here are key reasons many SMEs that plan to grow choose SAP Business One over UBS Accounting Software:

1. Future-proofing your ops

If you plan to expand (branches, products, regions), add complexity (manufacturing, customization), or use more advanced analytics — SAP gives you headroom. You’ll spend less “rewiring” later.

2. Centralised, real-time business intelligence

SAP B1 gives dashboards, analytic tools, query/reporting tools that span all company operations. This aids faster and more accurate decision-making.

3. Reduced duplication & manual work

Having all modules (sales, inventory, purchasing, accounting, production etc) in one integrated ERP reduces manual transfer of data, reconciliation, duplicate entries, inconsistencies.

4. Better control & compliance

Audit trails, multi-user permissions, internal controls, sophisticated fixed asset / depreciation tools, and more robust support for cross-entity financial consolidation, multi-currency foreign exchange, etc.

5. Scalability with performance

As transaction volumes increase, having a system designed for growth ensures your processes remain smooth (less lag, better performance), and avoids patch-up solutions or “band-aid” integrations.

6. Strong partner ecosystem for customization

Need specific industry workflows? Third-party add-ons? Localization beyond basic tax? SAP B1 has many available extensions and consultants who can build these. UBS has partners, but more limited in advanced/complex custom work.

7. Mobile, remote, cloud readiness

For modern businesses with remote sales, remote branches, need for mobile/online dashboards etc, SAP tends to offer more flexibility (cloud or hosted options, mobile access etc) than traditional on-premise or simpler desktop systems.

Possible Drawbacks and Mitigations

To be fair, SAP Business One is not perfect for every business. But many of its drawbacks can be managed.

| Drawback | Explanation | Mitigation / Consideration |

|---|---|---|

| Higher initial cost / implementation complexity | More modules, more features means more planning, training, possibly hardware / infrastructure. | Start with a core set of modules; pick a strong local implementation partner; phase implementation; use cloud / hosting options to reduce hardware investment; budget for change management. |

| Longer onboarding / training required | More features = steeper learning curve. | Proper user training; using simplified UI; customizing dashboards and screens so users see only what they need; using partner-provided templates. |

| Overkill for very simple operations | If all you do is basic invoicing, a few customers, low volume, minimal inventory, you may not need full ERP. | Evaluate carefully; perhaps use UBS initially, but plan ahead; when reaching thresholds (users, volume, branches) make the transition. Sometimes cost of transition is higher than starting ERP early. |

Local Market Considerations

- Regulatory compliance: SST in Malaysia, GST in Singapore (if applicable), e-invoicing mandates (e.g. LHDN in Malaysia from Aug 2024 onward). Any software must support these fully. SAP B1 implementations in Malaysia include modules or localization for SST, e-invoicing etc. UBS does too, but often the SAP B1 version gets support more robustly in cross-border or international use.

- Language / local formatting / tax-rules: UBS is strong here because it is developed or customised locally. SAP B1 also has partner-localised configurations to handle Malaysian tax, accounting standards, currency etc.

- SME Financing grants: Governments often provide grants / incentives for digital adoption (ERP, cloud). SME using SAP B1 might qualify for those, making net cost more affordable.

- Partner presence & support speed: Because UBS is local, support can be faster for simple issues; however, SAP B1 partners are also local and many have strong track records. For advanced issues, the global SAP ecosystem gives advantages in updates, security, feature enhancements.

- Cloud / remote work importance: With remote work, branch offices, mobile teams, cloud or hybrid deployment are more essential. SAP B1 has more maturity there; UBS is improving (mobile license, etc) but may not be yet at the same level of remote/distributed deployment and large-scale server performance.

Conclusion

While Access UBS (Sage UBS) remains a reliable, popular, cost-effective solution for many small to medium enterprises in Malaysia and Singapore — especially those with relatively simple operations and budgets — SAP Business One offers a more powerful, flexible, scalable, and integrated solution for businesses that plan to grow, handle multiple operations, need tighter controls and richer analytics.

If your business meets any of the following conditions, SAP Business One will likely deliver superior business value:

- You expect growth in branches, entities, or cross-border operations.

- You have or will have manufacturing, production, or complex inventory/supply chain needs.

- You need deep analytics, dashboards, forecasting, real-time visibility across entire operations.

- You want to reduce dependency on manual data reconciliation, duplicate entries, or isolated systems.

- You want to ensure compliance with evolving regulation, internal controls, auditability, data security.

In many cases, while the upfront cost and effort for SAP Business One are higher, the total cost of ownership over time—including saved man-hours, fewer errors, better margins, improved decision-making — becomes lower than sticking with limited systems or needing to retrofit workarounds.

If you’re an SME in Malaysia or Singapore considering moving beyond basic accounting, it’s worth:

- Mapping your current pain-points (e.g. multiple spreadsheets, poor visibility, slow reports, lack of production / inventory control).

- Getting demos of both UBS Evo / UBS modules and SAP Business One with local partner-customised workflows.

- Running a cost-benefit projection over 3-5 years: not just license fees, but implementation, training, maintenance, upgrades, support.

- considering how much flexibility you need: for example, integrating sales, CRM, production, logistics