InvoiceNow in Singapore is revolutionizing business financial transactions. This nationwide e-invoicing network streamlines operations, improves cash flow, and simplifies compliance. Integrating it with ERP systems like SAP Business One offers seamless, automated financial processes.

What is InvoiceNow Singapore?

At its core, InvoiceNow is Singapore’s nationwide e-invoicing network, meticulously designed to facilitate the easy sending and receiving of invoices and credit notes in a structured digital format. Introduced by the Infocomm Media Development Authority (IMDA) in 2019, InvoiceNow is built upon the internationally recognized “Peppol” standard.

The adoption of Peppol (Pan-European Public Procurement On-Line) is crucial, as it provides a standardized framework for cross-border electronic document exchange, ensuring interoperability and security.

By embracing this global standard, Singapore aims to foster a more interconnected and efficient business ecosystem, both domestically and internationally. This digital invoicing methodology significantly reduces the reliance on manual processing and recording of invoices within accounting systems, thereby helping businesses mitigate tedious work and common errors.

The Compelling “Why”: Benefits of Adopting InvoiceNow

The transition to InvoiceNow offers substantial mutual benefits for businesses of all sizes, from Small and Medium Enterprises (SMEs) to large enterprises. The advantages span across operational efficiency, financial health, and regulatory compliance.

1. Enhanced Efficiency and Accuracy

One of the most immediate benefits of InvoiceNow is the marked improvement in the timeliness and accuracy of invoice processing. By converting invoicing into a structured digital format, the system minimizes human intervention, leading to fewer errors and discrepancies. This automation frees up valuable time and resources that would otherwise be spent on manual data entry, reconciliation, and error correction.

2. Faster Payments and Stronger Relationships

Timely and accurate invoice processing directly translates to faster payments. When invoices are delivered and processed digitally and instantly, the payment cycle shortens considerably. This not only improves a business’s cash flow but also fosters stronger relationships with vendors and customers, built on trust and efficiency. For suppliers, quicker payments mean better liquidity, while buyers benefit from streamlined reconciliation and reduced administrative overhead.

3. Streamlined Compliance and Auditing

InvoiceNow plays a pivotal role in simplifying compliance efforts, particularly concerning Goods and Services Tax (GST) audits. The structured digital format of invoices ensures that all necessary data elements are captured consistently, making it easier for businesses to meet regulatory requirements. Furthermore, the digital trail created by InvoiceNow transactions shortens the GST audit process, as tax authorities can access accurate and readily verifiable data directly from the system. This minimizes the burden on businesses during audits and reduces the risk of non-compliance penalties.

4. Reliability of Data Transmission

The network enhances the reliability of data transmission. Unlike traditional methods prone to lost mail or delayed deliveries, InvoiceNow ensures that invoices and credit notes are securely and reliably transmitted between businesses and to regulatory bodies like the Inland Revenue Authority of Singapore (IRAS). This secure and standardized exchange of data is foundational for building trust in digital transactions.

The Roadmap to InvoiceNow Adoption: Key Dates and Steps

Singapore’s government, through IMDA and IRAS, has outlined a clear roadmap for the adoption of InvoiceNow, making it a mandatory requirement for certain GST-registered businesses over time. This phased approach allows businesses to prepare and transition smoothly.

Key Implementation Dates for GST InvoiceNow Requirement:

1 May 2025 (Soft Launch): All GST-registered businesses that wish to get a head start can begin submitting invoice data to IRAS using InvoiceNow-Ready Solutions.

1 November 2025: Newly incorporated companies from 1 May 2025 that apply for voluntary GST registration will be required to start submitting invoice data to IRAS using InvoiceNow-Ready Solutions.

1 April 2026: All new voluntary GST registrants (regardless of incorporation date or business constitution) will be required to start submitting invoice data to IRAS using InvoiceNow-Ready Solutions.

Steps to Become InvoiceNow-Ready

Businesses looking to adopt InvoiceNow should follow a structured three-step process:

1. Ensure Your Solution is InvoiceNow-Ready:

The first step involves verifying if your preferred accounting or finance solution is listed among IMDA’s accredited InvoiceNow-Ready Solution Providers [Activate InvoiceNow in SAP Business One].

2. Register for InvoiceNow and Obtain Your Peppol ID:

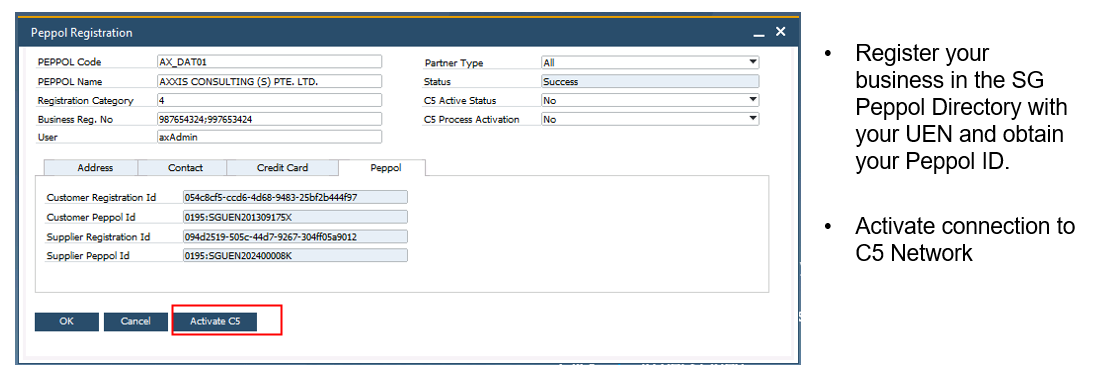

Businesses need to approach their Solution Provider and/or Access Point Provider to register their business in the SG Peppol Directory using their Unique Entity Number (UEN) and obtain their unique Peppol ID [contact us].

3. Enable and Test GST InvoiceNow Submission:

The final step involves enabling the GST InvoiceNow submission feature within your accounting or finance solution and rigorously testing the system. For businesses utilizing in-house enterprise solutions, it is crucial to contact an Access Point Provider to ensure the solution is connected to InvoiceNow and that the GST InvoiceNow submission feature is activated.

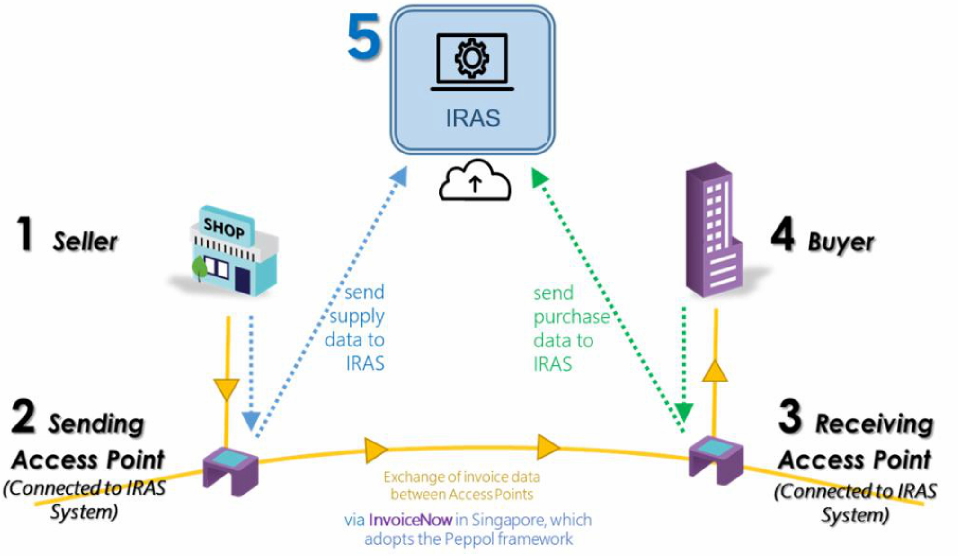

The InvoiceNow Process Workflow: A 5-Corner Model

InvoiceNow extends the traditional four-corner e-delivery model to a 5th corner, integrating directly with the IRAS system for streamlined GST submissions. This comprehensive workflow ensures that invoice data flows efficiently and securely from seller to buyer, with a copy funneled to IRAS for regulatory purposes.

The workflow typically involves:

1. Seller: Initiates the process by sending supply data.

2. Sending Access Point (Connected to IRAS System): The seller’s Access Point transmits the invoice data. Invoice data is exchanged between the sending and receiving Access Points through the InvoiceNow network. Access Points act as accredited Peppol Service Providers by IMDA, facilitating the secure and standardized exchange of documents.

3. Receiving Access Point (Connected to IRAS System): The buyer’s Access Point receives the invoice data.

4. Buyer: Receives the purchase data.

5. IRAS: Copies of live invoices and extracted invoice data are funneled to the IRAS system, representing the crucial 5th corner.

Data Flow Types for Comprehensive Transaction Management

InvoiceNow accommodates various data flow types to cover both Accounts Receivable (AR) and Accounts Payable (AP) scenarios, ensuring a holistic approach to digital invoicing.

1. Accounts Receivable (AR)

For businesses issuing invoices and credit notes to their customers, InvoiceNow supports different transmission types:

- Flow Type A (Peppol Sending): Businesses send invoices and credit notes directly via the Peppol network, ensuring a structured digital format.

- Flow Type B (Non-Peppol Sending): For customers not on the Peppol network, businesses can still send invoices and credit notes through traditional channels, with the data aggregated and recorded in the Invoice System for eventual submission to IRAS.

- Flow Type C (Cash Register/POS Devices): This scenario covers sales transactions made through cash registers or Point-of-Sale (POS) devices, where data is aggregated before being recorded in the Invoice System.

2. Accounts Payable (AP)

For businesses receiving purchase invoices and credit notes from their suppliers:

- Flow Type D (Peppol Receiving): Businesses receive purchase invoices and credit notes directly from suppliers via the Peppol network.

- Flow Type E (Non-Peppol Receiving): For suppliers not utilizing the Peppol network, businesses receive invoices through alternate methods, with the data then recorded in their Invoice System.

- Flow Type F (Petty Cash Purchases): This addresses scenarios where businesses make petty cash purchases, and the aggregated data is recorded in the Invoice System.

Both Peppol and Non-Peppol transmission types are ultimately sent to IRAS servers via an Access Point, ensuring comprehensive data submission. The standard format for Peppol documents is BIS or PINT.

Mandatory Data Elements for InvoiceNow Compliance

To ensure seamless processing and compliance with IRAS requirements, invoices and credit notes transmitted via InvoiceNow must include specific mandatory data elements. These elements cover details about the seller, buyer, and the invoice/credit note itself.

| Seller Details | Buyer Details |

| Supplier Endpoint ID | Customer Endpoint ID |

| Supplier Scheme ID | Customer Scheme ID |

| Supplier UEN | Customer UEN |

| Supplier GSTIN | Customer Name |

| Supplier Name | Customer Address (Address Line 1, Postal Code, Country Code) |

| Supplier Address (Address Line 1, Postal Code, Country Code) |

| Invoice Details | |

| Customization ID | Item Net Price excluding GST |

| Profile ID | Item GST Category Code |

| Doc UUID (Unique Invoice Identifier) | Item GST Category Rate |

| Invoice Number | Invoice Line Net Amount |

| Invoice Date | Sum of Invoice Line Net Amount |

| Invoice Type Code (e.g., invoice or credit note) | Subtotal GST Category Amount |

| Invoice Currency Code | Subtotal GST Category Taxable Amount |

| GST Category Code (e.g., GST tax model) | Subtotal GST Category Rate |

| GST Category Rate (e.g., GST rate for the tax code) | Total GST Amount |

| Invoice Line Identifier | Total Invoice Amount without GST |

| Item Name | Total Invoice Amount with GST |

| Unit | Amount due for Payment |

| Quantity | |

*For non-SGD invoices, sgdtotal-excl-gst and sgdtotal-incl-gst are also required.

Similar mandatory fields apply to credit notes, ensuring consistency and full traceability.

| Credit Note Details | |

| Customization ID | Item Net Price, excluding GST |

| Profile ID | Item GST Category Code |

| Doc UUID (Unique invoice Identifier) | Item GST Category Rate |

| Credit Note Number | Credit Note Line Net Amount |

| Credit Note Date | Sum of Credit Note Line Net Amount |

| Invoice Type Code (i.e., invoice or credit note) | Total GST Amount |

| Credit Note Currency Code | Total Credit Note Amount without GST |

| GST Category Code (i.e., GST tax code) | Total Credit Note Amount with GST |

| GST Category Rate (i.e., GST rate for the tax code) | Amount due for Payment |

| Credit Note Line Identifier | Preceding Invoice number |

| Item Name | Preceding Invoice issue date |

| Unit | Invoice Note |

| Quantity | |

Axxis SAP B1 Singapore InvoiceNow Add-on: Bridging the Gap

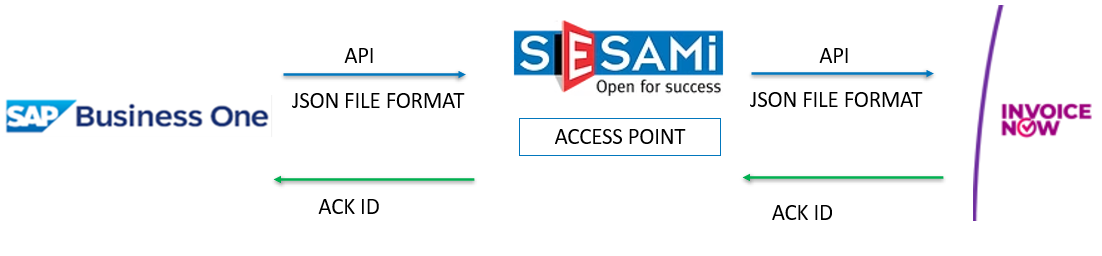

For businesses utilizing SAP Business One, specialized add-ons like the Axxis SAP B1 Singapore InvoiceNow Add-on play a crucial role in facilitating seamless integration with the InvoiceNow network. This add-on connects your SAP B1 system directly with an IMDA-accredited Access Point provider using APIs (Application Programming Interfaces) such as SESAMi for InvoiceNow.

Benefits of the Axxis SAP B1 InvoiceNow Add-on

1. Compliance: Ensures continuous compliance with the latest IMDA guidelines.

2. Comprehensive Data Capture: Consists of all necessary fields required by IRAS for accurate data submission.

3. Seamless Data Extraction: Efficiently extracts all necessary information from SAP B1, minimizing manual data preparation.

4. Flexible Upload Options: Supports both individual and batch uploads to the IMDA Portal.

5. C5 Network Integration: Enables activation of connection to the C5 Network, which funnels data to IRAS. This connection can be activated or deactivated as needed.

Successful Activation of C5 in Axxis InvoiceNow Addon:

Operational Workflow with the InvoiceNow Add-on

Axxis Consulting offers a structured operational workflow with the B1 InvoiceNow add-on solution, streamlining the process of sending and receiving invoices and credit notes. It can be seamlessly implemented into your existing system with minimal disruption. Schedule an appointment with us to explore how it works for your business.

Conclusion

InvoiceNow Singapore advances digital transformation with a secure e-invoicing network, streamlining financial operations, speeding payments, and ensuring compliance. Integrating with ERP systems like SAP Business One further optimizes this. As the deadlines for mandatory adoption approach, proactive adoption is crucial for businesses to achieve a more efficient, accurate, and agile financial future, boosting Singapore’s global competitiveness.